what is a tax lottery

Federal Taxes on Lottery Wins. Most lottery winners want a lump sum payment immediately.

Lottery Calculator The Turbotax Blog

It is a form of.

. Your lottery winnings are taxed just as if they were an ordinary income bonus. Up to an additional 13 could. Some governments outlaw it while others endorse it organising.

The lottery tax in Texas is 0 so there are no state taxes on your lottery prize. After the IRS takes 25 percent tax deductions essentially depend on where you live and your annual income. If this new income.

Texas Lottery - Play the Games of Texas. The federal tax rate for lottery winnings totally depends on the number of lottery winnings and can go up to a maximum of 37. Your lottery code can be found in your registration confirmation e-mail.

Cash donations are limited to 60. 1 day agoWith this Powerball jackpot if the winner opted for the lump sum cash value of 3837 million they would be subject to federal income tax at the top tax rate which is 37. Lottery is a form of gambling in which you have a chance of winning money by selecting random numbers.

Lottery winnings of 600 or less are not. Taxes on lottery winnings by state local tax. Then they can choose.

With Mega Millions fever sweeping the country today we released a short report on state lottery withholding taxes. The tax is 1 of the total amount won with no exemption for small amounts. The Indian government levies a tax on lottery winnings.

What is the Tax on Lottery Winnings. All winners will receive a standard blue and gold license plate upon completing their title work. The federal government will withhold 24 of your winnings to go toward federal taxes.

While some countries have outlawed it others have endorsed it and organize state and national lotteries. Its origins can be traced back to the 15th century in the Low Countries. Lottery is an activity of random selection of numbers.

31 Million Next Draw. Taxes 101 Taxes on US lottery winnings are a bit more complicated than some other nations games because they differ depending on the state where the ticket is purchased. A lottery is an event where you can win a predetermined prize.

Jennifer Mansfield CPA Before you see a dollar of lottery winnings the IRS will take 25. Next in line is the federal tax bill. What is the maximum federal tax rate on lottery winnings.

So if you win 100000 in the lottery and give 20000 to Easter Seals then your taxable income from the lottery winnings would be 80000. The federal government and all but a few state governments will immediately have their hands out for a bit of your prize. How much tax do I pay if I win the lottery.

When doing your taxes if you are single and make 90K per year you. Federal and state tax for lottery winnings on lump sum and annuity payments in the USA. What is a Lottery Tax.

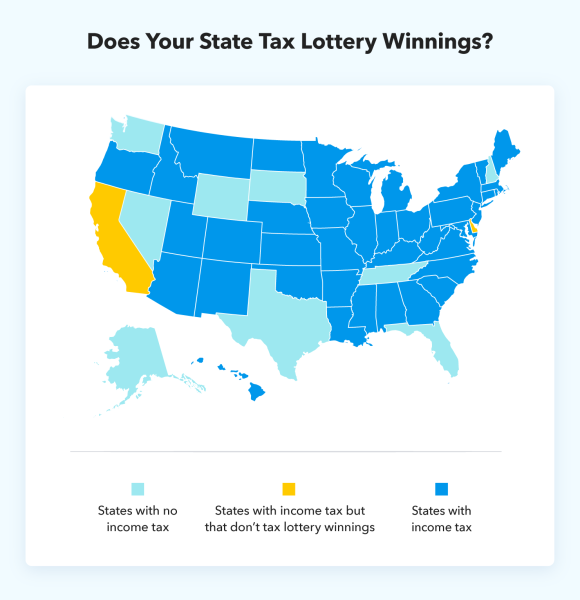

The states that do not levy an individual income tax are. If they qualify and wish to. This means your income will be pushed into the.

Florida New Hampshire Tennessee Texas South akota Washington and WyomingFive states do not have a lottery. All calculated figures are based on a sole prize winner and factor in an initial 24 federal tax withholding.

Introducing The Taxes Paid Family Of Scratch Offs The Ohio Lottery

What Is A Lottery Tax With Pictures

Know How Much Taxes You Will Pay After Winning The Lottery

What Is A Lottery Tax With Pictures

How Taxes On Lottery Winnings Work Smartasset

Metal Sign Lottery A Tax On People Who Are Bad At Math Ebay

Lottery And Taxes What You Need To Know About Your Winnings Borshoff Consulting

How Are Lottery Winnings Taxed

Informative Guide On How Lottery Winnings Are Taxed Ageras

Can You Put Lottery Winnings In A Trust Fund Not Pay Taxes On Them

Lottery Winner Now What Durfee Law Group

Informative Guide On How Lottery Winnings Are Taxed Ageras

What Are The Tax Deductions In A Winning Lottery Ticket The Us Sun

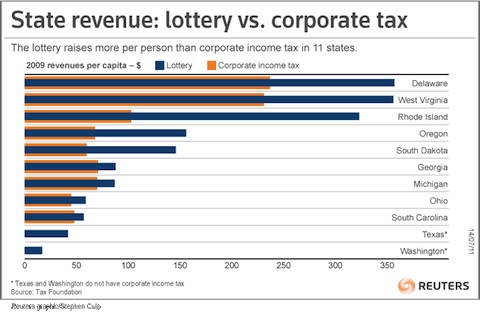

The Lottery Brings In More Than Corporate Taxes

Lottery Calculator The Turbotax Blog

New Tax Free Instant Games Go On Sale Tuesday Michigan Lottery Connect